- Hermetica

- Posts

- Weekly Update - January 30, 2026

Weekly Update - January 30, 2026

Bitcoin’s ZK Rollup Is Live

IN THIS ISSUE

🍋 Bitcoin’s ZK Rollup Is Live

🪙 New Year. Same Transparency.

💰 USDh Yield Recap

📈 Weekly Market Review

Jakob TL;DR

Did you catch the Citrea launch?

Citrea is live on mainnet, and I’ve been playing around with it. Citrea anchors BTC with ZK + BitVM2, enabling unilateral exits back to mainnet as long as there’s one honest signer to detect and challenge malicious behavior. It’s a meaningful step away from standard multi-sig or custodial trust assumptions.

While new BTC rails come to market, we keep setting the transparency standard for new entrants to BTCFi.

One month into 2026, USDh remains fully backed, with January custodian attestations independently verified by Copper and Ceffu.

Bitcoin’s ZK Rollup Is Live

Citrea mainnet goes live: Bitcoin's ZK rollup and application layer.

Citrea brings lending and trading to BTCFi through cBTC, a trust-minimized BTC representation powered by Clementine, a collateral-efficient bridge.

Clementine uses BitVM2 to enable unilateral exits back to mainnet, a departure from the standard multi-sig or custodial trust assumptions. BitVM2 works in an “optimistic” way: most of the time, nothing needs to happen on Bitcoin because everyone assumes the bridge is behaving correctly. Bitcoin only gets involved if someone thinks the bridge is misbehaving and decides to challenge it. The safety backstop relies on at least one honest watcher who is actually online, paying attention, and willing to spend fees and time to push a challenge through even when the network is busy and fees are high.

In parallel, scaling solutions like Alpen are pushing approaches with BitVM3 that keep the same optimistic security model while making disputes economically feasible. Alpen’s Glock is built so the challenger doesn’t need to run a multi-step on-chain process to prove it. Instead, most of the verification work is off-chain using garbled-circuit techniques, and the on-chain enforcement is designed to be small and affordable.

This is the state of BTC-native verification today, we’re excited to see how these approaches converge.

Join Citrea to celebrate the launch:

New Year. Same Transparency.

The first custodian attestation for 2026 is live. USDh remains fully backed by Bitcoin, independently verified by Copper and Ceffu.

In summary, as of the snapshot time:

USDh supply: $5,215,659.35

Copper custodied assets: $2,932,652.36

Ceffu custodied assets: $2,206,049.57

Redeeming Reserve Stacks: $53,167.79

Redeeming Reserve Ethereum: $24,223.07

Minting Wallet: $0.00

Total backing assets: $5,216,092.79

Reserve Fund: $82,246.35

• USDC: $75,148.12

• USDh: $7,098.24Total % of USDh: 101.45%

See the full breakdown of USDh’s backing in the published attestations, or verify in real-time in the Transparency Dashboard

USDh Yield Recap

5 weeks in.

Your stablecoin is still printing. No, not the “Fed printer go brrr” kind.

The good kind.

Market Review

Bitcoin price declined this week, reaching a two-month low of $83,383 on Thursday as broader risk assets weakened and the NASDAQ dropped 1.5%. Gold briefly traded above $5,600 before retracing. Spot Bitcoin ETFs recorded more than $1.1B in net outflows over five consecutive trading days.

Data Summary:

DVOL: 43.75%

Equal-weighted futures basis spread: 3.64% APR

Futures curve is in an inverted contango, with front month trading above later maturations

Perp funding rates turned negative during Thursday's selloff

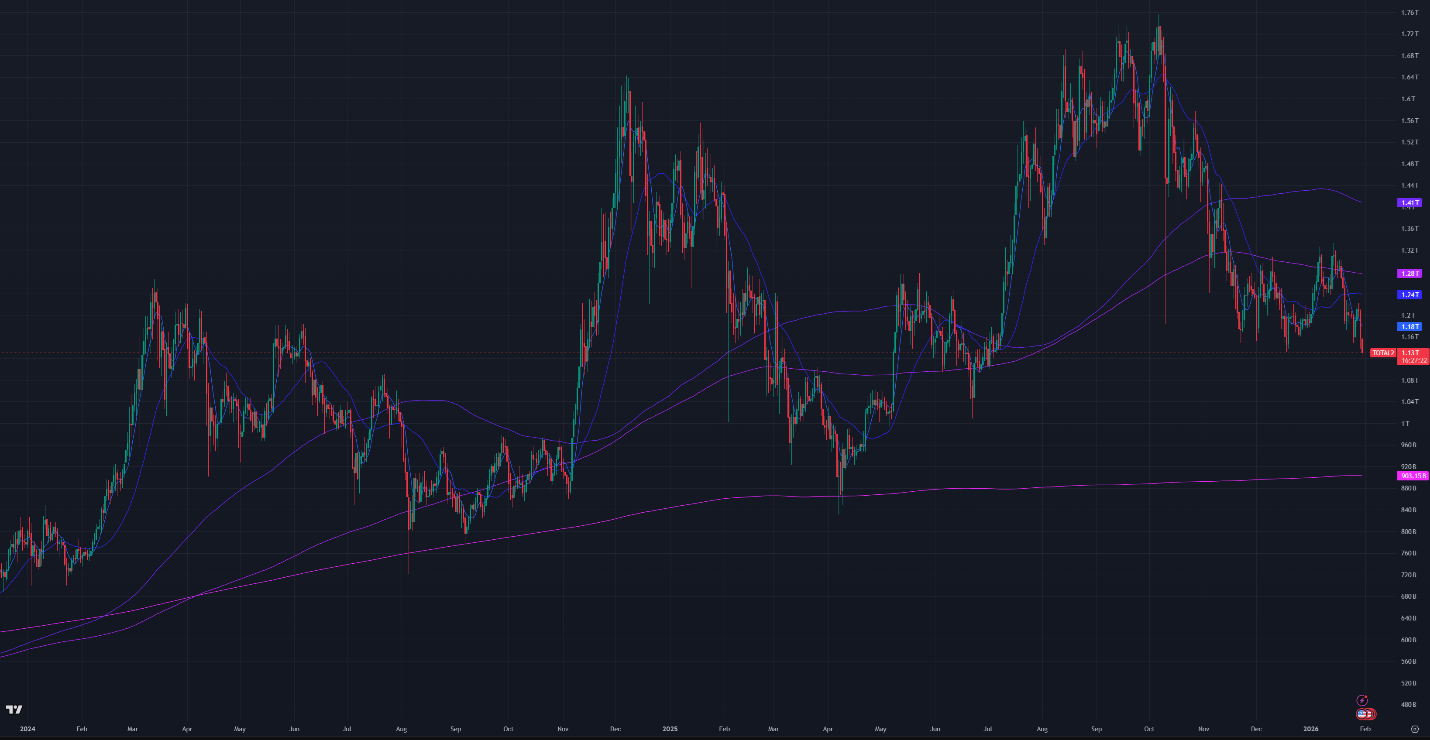

Aggregated altcoin market caps fell to $1.13T from $1.19T last week

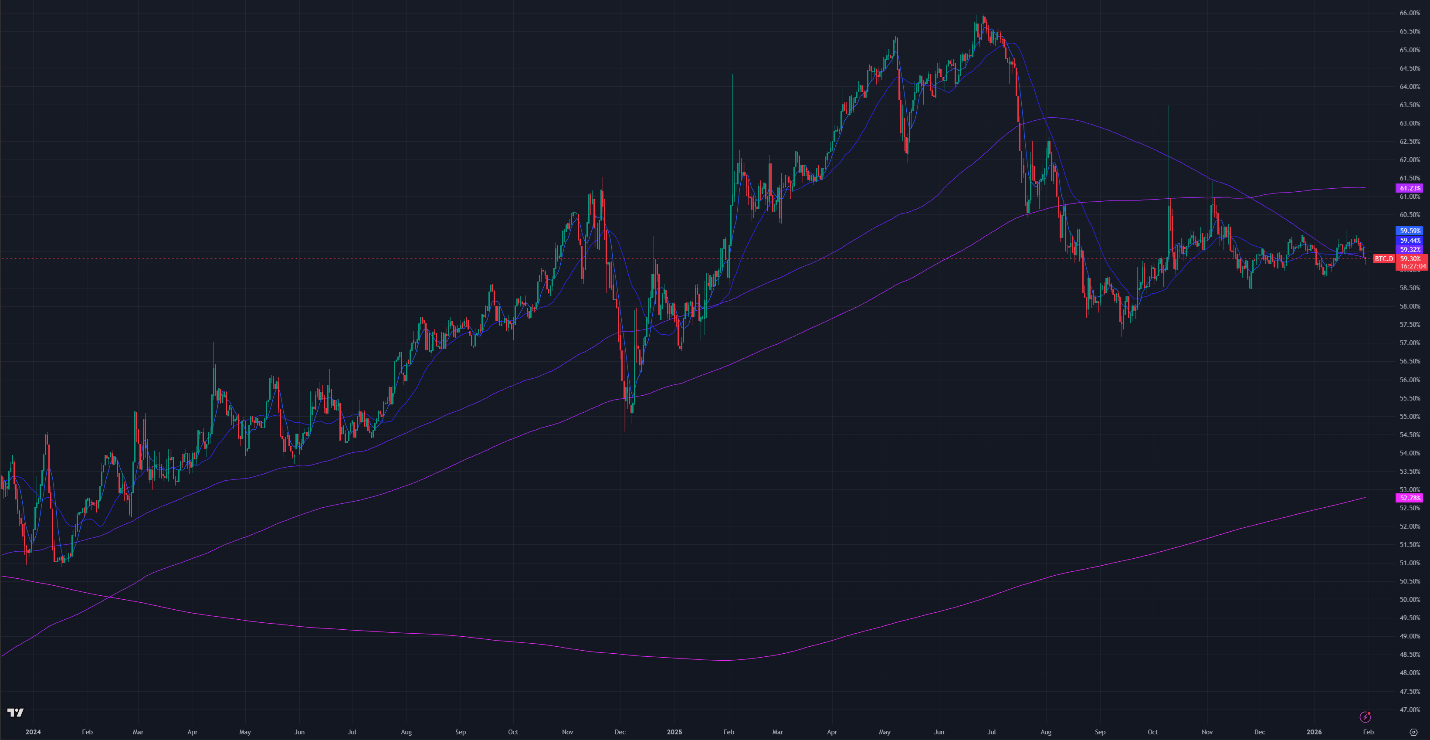

Bitcoin dominance fell by 0.49% to 59.30%

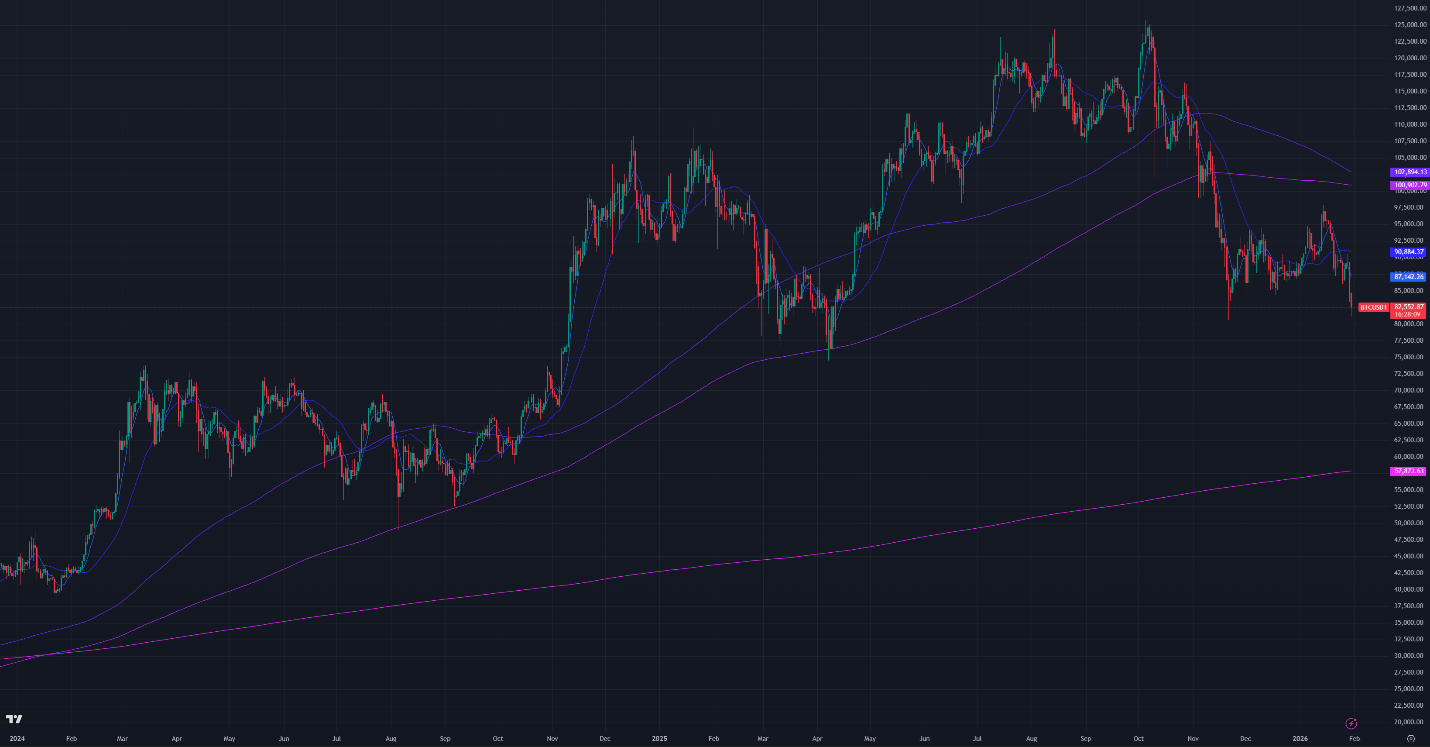

Figure 1: BTC Price, Daily Candles, & Moving Averages; 2 years; Source: Binance

Figure 2: Crypto Market Cap Excluding Bitcoin, Daily Candles, & Moving Averages; 2 years

Figure 3: Bitcoin Dominance, Daily Candles, & Moving Averages; 2 years

The moving averages (MA) in Figure 1 are:

Current Price: $82,600

7-Day MA: $87,200

30-Day MA: $90,900

180-Day MA: $102,900

360-Day MA: $100,900

200-Week MA: $57,900

Bitcoin now trades below the 7-day and 30-day short-term moving averages (MAs). Price broke below the 100-week simple MA (~$85,000) for the first time since November. Bitcoin continues to trade well below the 180-day and 360-day MAs, maintaining a downtrend. Key support levels below the current price are $75,000, $70,000, and the 200-week MA near $58,000.

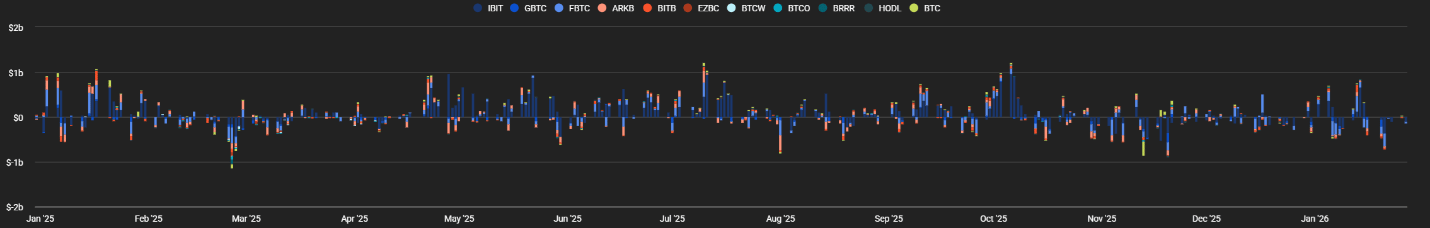

BTC ETF Flows

Net outflows totaled $1.082B over five consecutive days of redemptions. Outflows were concentrated in three products that accounted for about 92% of exits: Fidelity’s FBTC, Grayscale’s GBTC, and Ark’s ARKB. BlackRock’s IBIT was less impacted, but still recorded net outflows. Cumulative net inflows since launch are now roughly $55.5B, while total ETF assets declined to $115B, representing 6.7% of Bitcoin’s market cap.

Figure 4: Bitcoin ETF Flows, Daily Bars; Source: The Block

Volatility

Bitcoin’s implied volatility (DVOL) rose sharply during Thursday’s selloff as demand for downside hedges increased. DVOL increased from 37% to over 44% in a single trading session, the most significant single-day move since November, and currently sits at 43.75%, up from 38.32% last week. Despite this rapid increase, implied volatility remains within its historical mid-range, with an IV Rank of 36 and an IV Percentile near 50.

Since the October selloff, implied volatility has remained range-bound between the low 40% and low 50% levels within a broader downtrend. This week’s spike briefly moved above the upper end of that range before retracing. The move coincided with a higher VIX, consistent with a broader risk-off event.

Over the longer term, market-maker options hedging across Bitcoin-linked products such as ETFs, Bitcoin treasury companies, and miners has systematically compressed implied volatility and influenced price behavior around option expiration levels.

Figure 5: DVOL 2 Years; Bitcoin Index Price; Source: Deribit

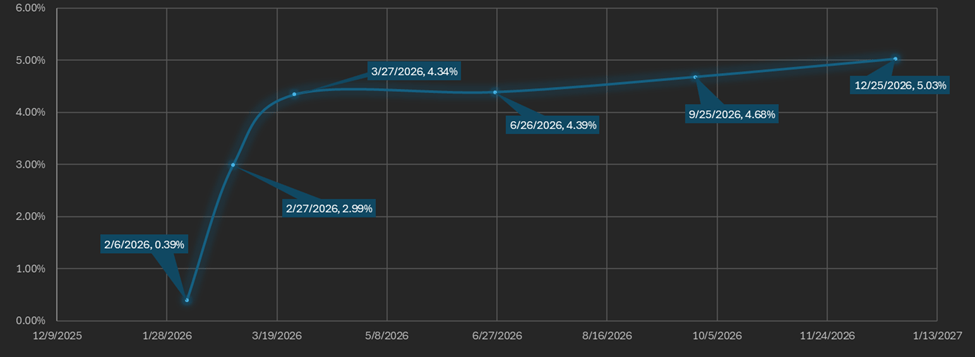

Basis Spread

The basis spread, or the price of the futures contract over its spot price, is positive across all maturities. The average (equal-weighted) basis spread fell 120 bps week over week, from 4.83% APR to 3.63% APR, as futures premiums compressed during the selloff.

The futures curve is in normal contango, with the front month (February 27) trading below the back month and later maturities. The spread between the lowest and highest yielding maturities widened to 4.63%, driven by basis compression in the front two maturities.

Figure 6: Futures Curve; Maturity Date, APR %

Macro

On January 28, the Federal Reserve held its first FOMC meeting of 2026 and kept the federal funds rate at 3.50%–3.75%, following three consecutive 25 bps cuts in September, October, and December 2025. The decision was not unanimous, with two Fed Governors dissenting in favor of a cut.

Markets saw broad risk-off moves throughout the week. Gold reached a record $5,626 per ounce on Thursday before retracing to around $5,200, while remaining on track for its strongest monthly gain since the 1980s. The U.S. dollar fell to four-year lows against major currencies.

Microsoft’s Q4 earnings report contributed to Thursday’s NASDAQ selloff as Microsoft stock dropped 11%, its largest one-day decline since March 2020. The NASDAQ dropped 1.5% and risk assets, including crypto, moved lower. Strategy (MSTR) declined 8% in its worst day since December.

The VIX rose to 19.74% during the selloff before easing to around 16.87% as markets stabilized, with the move reversing quickly after the spike.

Sincerely,

The Hermetica Team