- Hermetica

- Posts

- Weekly Update - January 23, 2026

Weekly Update - January 23, 2026

The Intent is in the Name

IN THIS ISSUE

💸 The Intent is in the Name

🏦 New ways to earn BTC

💰 USDh Yield Recap

📈 Weekly Market Review

Jakob TL;DR

What is in the name Hermetica?

Intent.

We didn’t choose Hermetica for branding. It reflects how we think about long-term structure, risk, and system behavior under stress.

Institutions think this way too. They pay close attention to systems that operate in line with their design over time. That is why they structure around Bitcoin. Balance sheets accumulate BTC directly. Equity wrappers gain Bitcoin treasury exposure, and insurance products earn Bitcoin-linked returns.

Bitcoin never drifts from its design, which makes it the perfect asset to accumulate and earn.

The Intent is in the Name

Names are not arbitrary. They communicate intent.

Hermetica was named deliberately to describe how the system is designed and how risk is handled.

The name references Hermes Trismegistus, historically associated with accounting, exchange, and mathematics. His role was mediation: preserving coherence as information moved across domains governed by different rules.

In complex financial systems, opacity compounds. Hidden risk does not disappear; it re-emerges elsewhere. Outcomes are determined by structure long before stress tests or interventions. The idea is simple. When structure is sound at the foundation, behavior remains predictable at the surface.

Bitcoin is a rare example of this principle working in practice. Security is grounded in energy, truth in mathematics, and transparency is built in its architecture

Hermetica applies the same logic to financial infrastructure built on Bitcoin. Risk controls and transparency are embedded structurally, ensuring system behavior remains predictable and observable even under pressure.

Find out what else the name Hermetica signifies, and why it reflects a commitment to disciplined system design.

New ways to earn BTC

Bitcoin continues to be engineered into balance sheets.

Strategy has turned its balance sheet into a Bitcoin accumulation engine. Its latest purchase of roughly 22,300 BTC brings total holdings to nearly 710,000 BTC. Equity and debt issuance are no longer ends in themselves; they act as a pipeline converting capital markets activity directly into long-term Bitcoin.

It’s not limited to Bitcoin-native firms. Vanguard completed its first-ever $505 million purchase of MSTR stock for indirect Bitcoin treasury exposure. Insurance companies are following the same trajectory. Delaware Life recently announced a partnership with BlackRock to offer fixed indexed annuities linked to an index that includes exposure to the iShares Bitcoin Trust ETF. Policyholders gain Bitcoin-linked upside within a principal-protected structure.

Bitcoin can support far more than passive holding. Institutions are already earning, structuring, and distributing Bitcoin exposure across multiple financial architectures.

The next step is inevitable. Bitcoin yield that is transparent and on-chain will soon be accessible without intermediaries or black boxes. Not just for institutions. For anyone.

Soon.

USDh Yield Recap

4% APY this week.

Corporate keeps yield behind layers of paperwork. We took the lock off.

If you can open a wallet, you can earn yield.

Market Review

Bitcoin hit $97,000 last week before falling to $87,400 during a broader risk-off move, though prices recovered to near ~$89,000 by January 22. Volatility was elevated amid shifting geopolitical developments and Strategy’s $2.125B Bitcoin purchase disclosed in its January 20 8-K filing.

The S&P 500 recorded its worst daily performance since October on Tuesday, falling 2.06%. The markets have since recovered.

Data Summary:

DVOL: 38.32%

Equal-weighted futures basis spread: 4.83% APR

Futures curve is in an inverted contango, with front month trading above later maturations

Perp funding rates were positive this week despite volatility

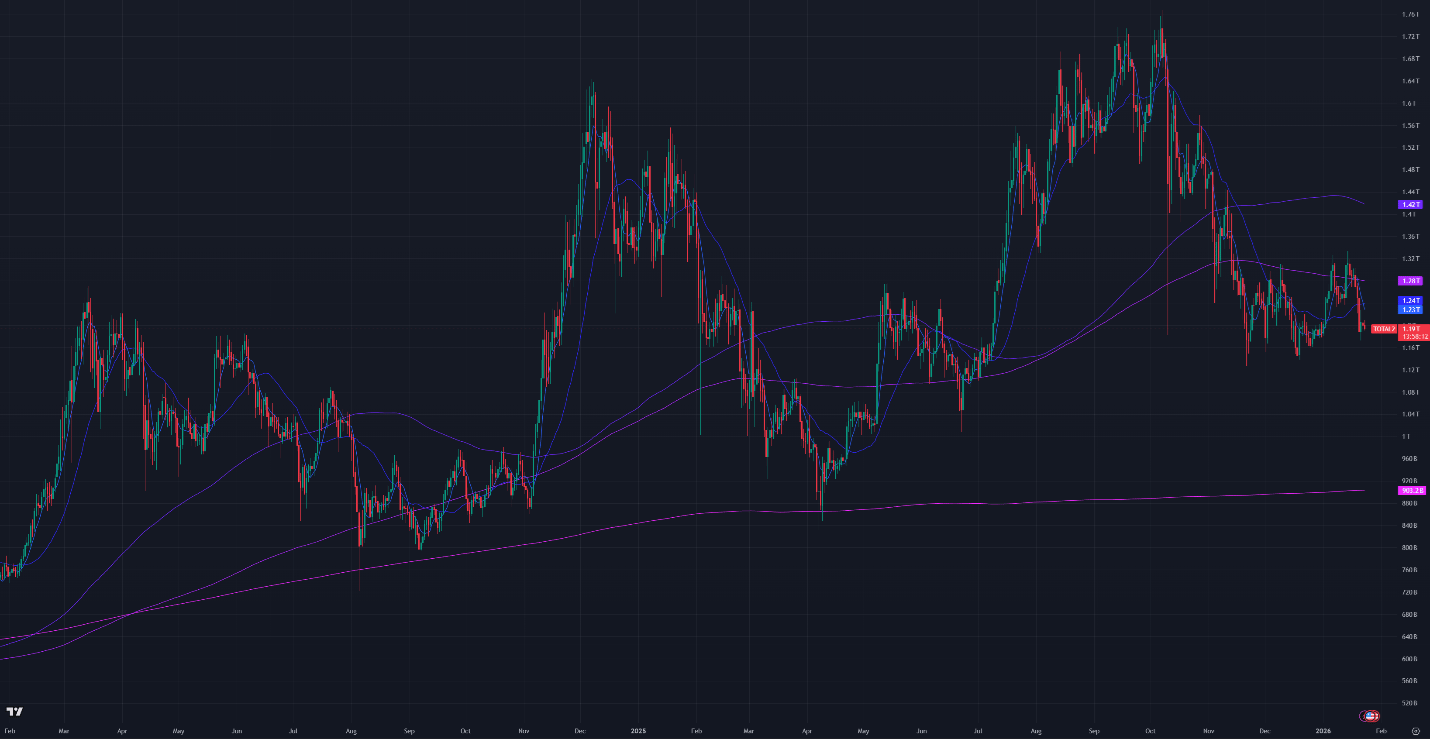

Aggregated altcoin market caps fell from $1.29T to $1.19T

Bitcoin dominance rose by 0.11% to 59.79%

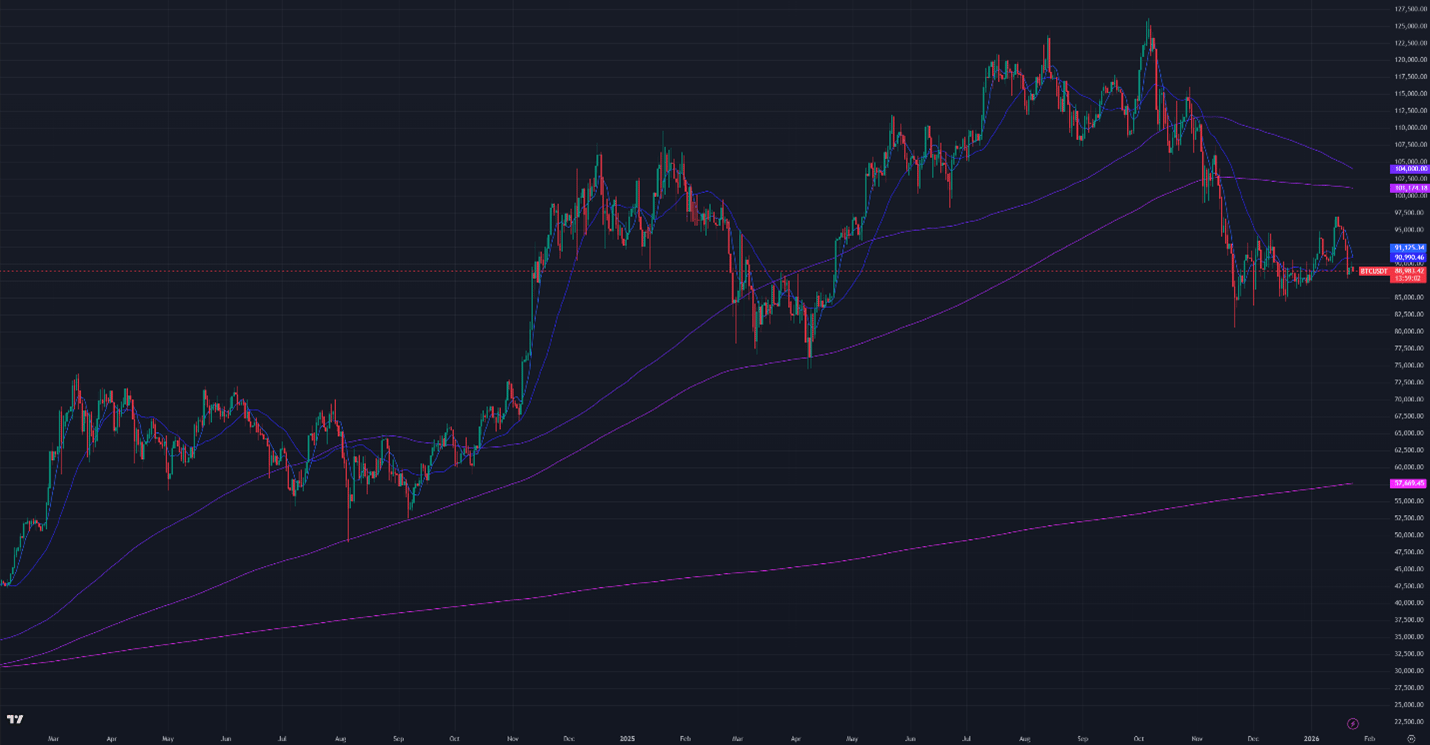

Figure 1: BTC Price, Daily Candles, & Moving Averages; 2 years; Source: Binance

Figure 2: Crypto Market Cap Excluding Bitcoin, Daily Candles, & Moving Averages; 2 years

Figure 3: Bitcoin Dominance, Daily Candles, & Moving Averages; 2 years

The moving averages (MA) in Figure 1 are:

Current Price: $89,000

7-Day MA: $91,100

30-Day MA: $91,000

180-Day MA: $104,000

360-Day MA: $101,200

200-Week MA: $57,700

Bitcoin is currently trading near the short-term moving averages (7-day and 30-day). Price is currently in a downtrend, as it trades below the longer-term 180-day and 360-day moving averages. Key support levels below the current price are $86,000, $80,000, $76,000, and $57,500.

BTC ETF Flows

Net outflows totaled $1.615B. Cumulative net inflows since launch have surpassed $56.6B, with total ETF assets at $126B, representing roughly 6.5% of Bitcoin’s market cap.

Figure 4: Bitcoin ETF Flows, Daily Bars; Source: The Block

Volatility

Bitcoin implied volatility (DVOL) rose during Wednesday’s selloff amid a broad risk-off move across asset classes, accompanied by reduced liquidity as market-making activity thinned. DVOL currently stands at 38.32%, down from 40.14% at the end of last week. During the most volatile period on Wednesday, DVOL briefly peaked at 42.4% before retracing as market conditions stabilized.

Strategy completed its most recent Bitcoin purchases at an average price of approximately $95,300, near the weekly high and roughly $5,000 above prevailing prices before the start of the buying program. The purchase coincided with a normalization in liquidity conditions, as previously accumulated inventory was redistributed into the market. This dynamic, common during large discrete flows, contributed to the volatility observed earlier in the week.

Since the October drawdown, volatility has remained range-bound between low-40% and low-50% levels. The brief spike this week highlights continued low liquidity, while the quick normalization suggests relatively balanced market-maker positioning. Volatility remains in a longer-term downtrend driven by market-maker options hedging across Bitcoin-linked products such as ETFs, Bitcoin treasury companies, and miners.

Figure 5: DVOL 2 Years; Bitcoin Index Price; Source: Deribit

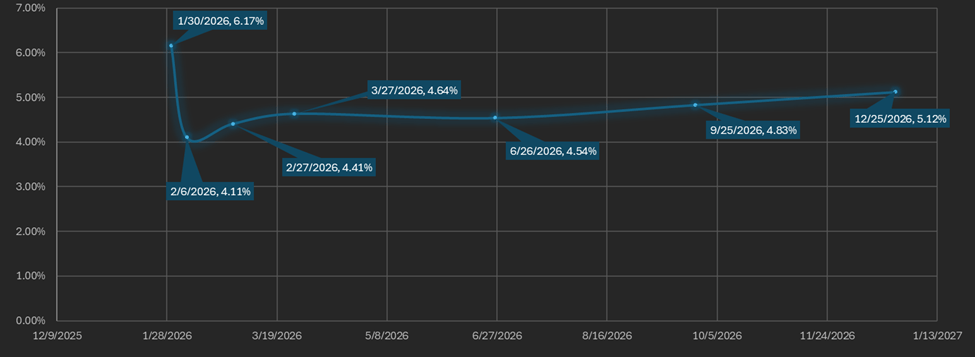

Basis Spread

The basis spread, or the price of the futures contract over its spot price, is positive across all maturities. The average (equal-weighted) basis fell 0.05 basis points from 4.89% APR to 4.83% APR week over week as market volatility compressed futures premiums.

The futures curve is in inverted contango, with the front month (January 30) trading above both the back month and later maturities. The spread between the lowest and highest yielding maturity rose to 2.05%, driven by strength in the front month, while the rest of the basis curve remained largely flat, unchanged from last week.

Figure 6: Futures Curve; Maturity Date, APR %

Macro

On December 10, the Federal Reserve cut the federal funds rate by 25 bps to 3.50%–3.75%, marking the third consecutive cut of 2025. The next FOMC meeting is scheduled for January 27–28. Recent economic data supports a pause, with Q3 GDP revised up to 4.4%, jobless claims holding near 200,000, and PCE inflation in line with expectations. The Fed's dot plot from December implied an additional 25 bps cut in 2026, bringing the median federal funds rate to the 3.25%-3.50% range by year-end.

President Trump renewed talks with Denmark and NATO to reach a framework of a deal for US access to Greenland. Separately, Federal Reserve governance was discussed, and Treasury Secretary Scott Bessent said the administration has narrowed its shortlist for the next Fed Chair.

Gold continued its rally, reaching $4,968 per ounce, while equity volatility briefly spiked before easing. The VIX spiked to 20.02% before returning to its long-term average. Interest-rate-adjusted MOVE index remains at 13.33%, near multi-year lows, indicating confidence in Treasury markets

Sincerely,

The Hermetica Team