- Hermetica

- Posts

- Weekly Update - January 16, 2026

Weekly Update - January 16, 2026

The Year of BTC Yield

IN THIS ISSUE

🗓️ The Year of BTC Yield

🏦 Inside the Institutional Playbook

⏰ You are Early

💰 USDh Yield Recap

📈 Weekly Market Review

Jakob TL;DR

Bitcoin has crossed the institutional thresholds that matter; strong custody solutions exist and balance sheets are in place.

This year, we'll see the Bitcoin focus shift to productivity. Institutions treat BTC as long-duration capital and need to see yield along with it.

It’s not exclusive to institutions, though. Earlier this week, I joined a Stacks webinar to break down how institutions approach earning on Bitcoin, and how that same structural playbook can now be applied on-chain.

TLDR: Your BTC can earn yield on-chain

The Year of BTC Yield

Bitcoin has entered a new phase of its lifecycle.

It has matured into a trillion-dollar asset class that is increasingly held by institutions. Spot ETFs, corporate treasuries, asset managers, and even sovereign entities now treat Bitcoin as a strategic asset for the balance sheet. Bitcoin is increasingly treated as a long-term portfolio holding.

However, a structural gap remains: yield.

In traditional finance, capital is never left idle. Cash is continuously deployed into yield-bearing instruments, and capital that does not earn is viewed as misallocated.

Bitcoin, by contrast, earns nothing. Despite being a $2T+ asset class, less than 1% of BTC is deployed into yield-generating structures.

Early attempts at Bitcoin yield relied on opacity, leverage, and trust assumptions institutions could not underwrite. When those failed, the pendulum swung the other way. Custody was preserved, but yield largely disappeared. Bitcoin stayed safe, but idle.

Hermetica operates between these two extremes.

Transparency is a design constraint, not a feature. Risks must be observable, mechanisms verifiable, and assumptions testable in real-time. The result is conservative, durable Bitcoin yield built to minimize blow-up risk rather than chase headlines.

hBTC launches this winter. A second Bitcoin yield product is in development and will be shared as it comes into focus.

We’ll define the Bitcoin capital markets in 2026. Our 2026 outlook tells the full story.

Inside the Institutional Playbook

What’s actually in the institutional yield playbook?

Jakob joined a Stacks webinar on productive Bitcoin and institutional yield to share how institutions approach earning on BTC.

Watch the webinar to learn how institutions structure around Bitcoin to capture yield through repeatable, risk-controlled systems.

You can earn on-chain the same way, you just have to know how.

You are Early

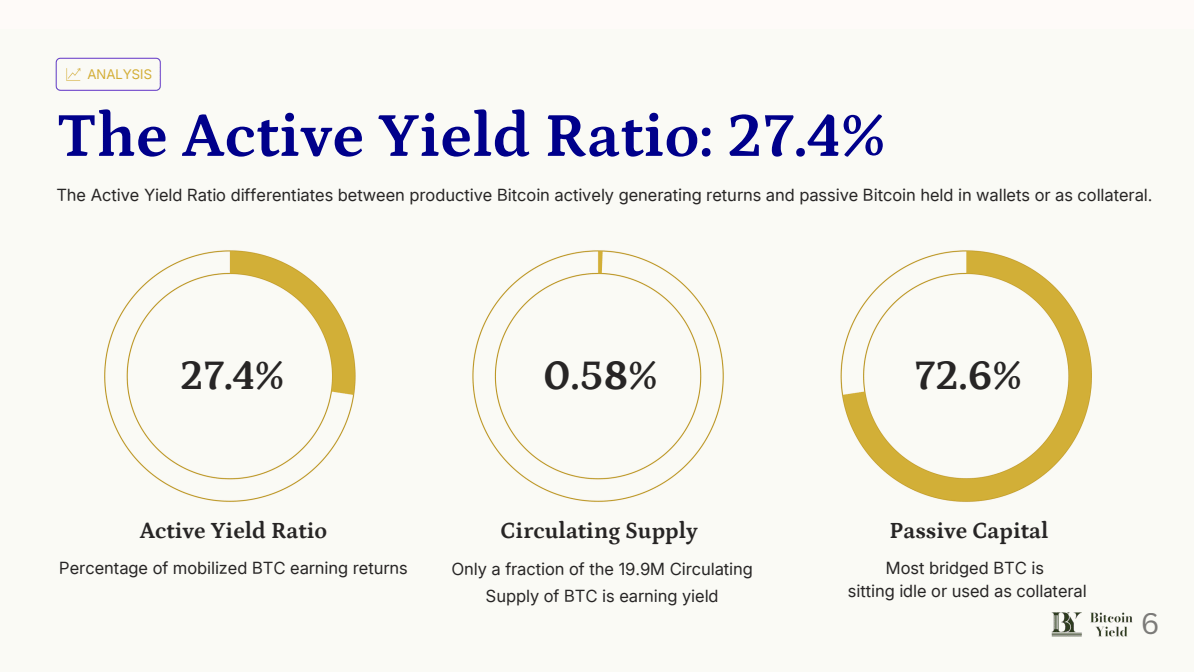

A report from Bitcoin Yield, a platform that tracks yield products across the Bitcoin ecosystem, puts hard numbers behind the growing demand for BTC returns.

Roughly 422,695 BTC is positioned to earn yield. Of that, about 280,000 BTC sits in custodial wrappers like WBTC and cbBTC, ~61,000 BTC is staked natively via Babylon, and just ~39,000 BTC is spread across sidechains and trust-minimized bridges. That is the entire addressable Bitcoin yield market right now.

75% of bridged Bitcoin relies on custodial structures, largely because that is where liquidity is. Non-custodial yield is growing, but it remains smaller, more fragmented, and harder to access at scale. At the same time, a Bitcoin yield curve has formed, spanning low single-digit base yields through to double-digit strategies priced for volatility and smart contract risk.

If you are reading this now, you are early. Fewer than 500,000 BTC globally is positioned for yield; the market is still forming.

Front-row access to the clearest expression of a complete Bitcoin yield structure is filling quickly. Join the hBTC waitlist while you can.

USDh Yield Recap

Please find attached this week’s 10% APY.

For avoidance of doubt, the figure is accurate and yield continues to compound as designed.

Thank you for your continued cooperation.

Market Review

Bitcoin rallied above $97,000 for the first time since mid-November before settling near $95,700. The move coincided with a reversal in ETF flows, as spot Bitcoin ETFs recorded more than $1.7B in net inflows over three consecutive trading days, the largest weekly inflow since October. Despite the price move, Deribit implied volatility decreased to 38% before returning to the low 40s and remains near two-year lows.

U.S. equities reached new highs this week, with the S&P 500 up 0.6% and the Dow Jones up 0.5%. The NASDAQ gained 0.8%, led by semiconductors after Taiwan Semiconductor reported strong earnings and announced higher AI-related capital spending.

Bank earnings exceeded expectations, with Goldman Sachs and Morgan Stanley reporting strength in dealmaking activity. BlackRock reported record assets under management.

Data Summary:

DVOL: 40.14%

Equal-weighted futures basis spread: 4.89% APR

Futures curve is in normal contango, with front month trading below later maturities

Perp funding rates peaked at 24% APR as prices rallied midweek

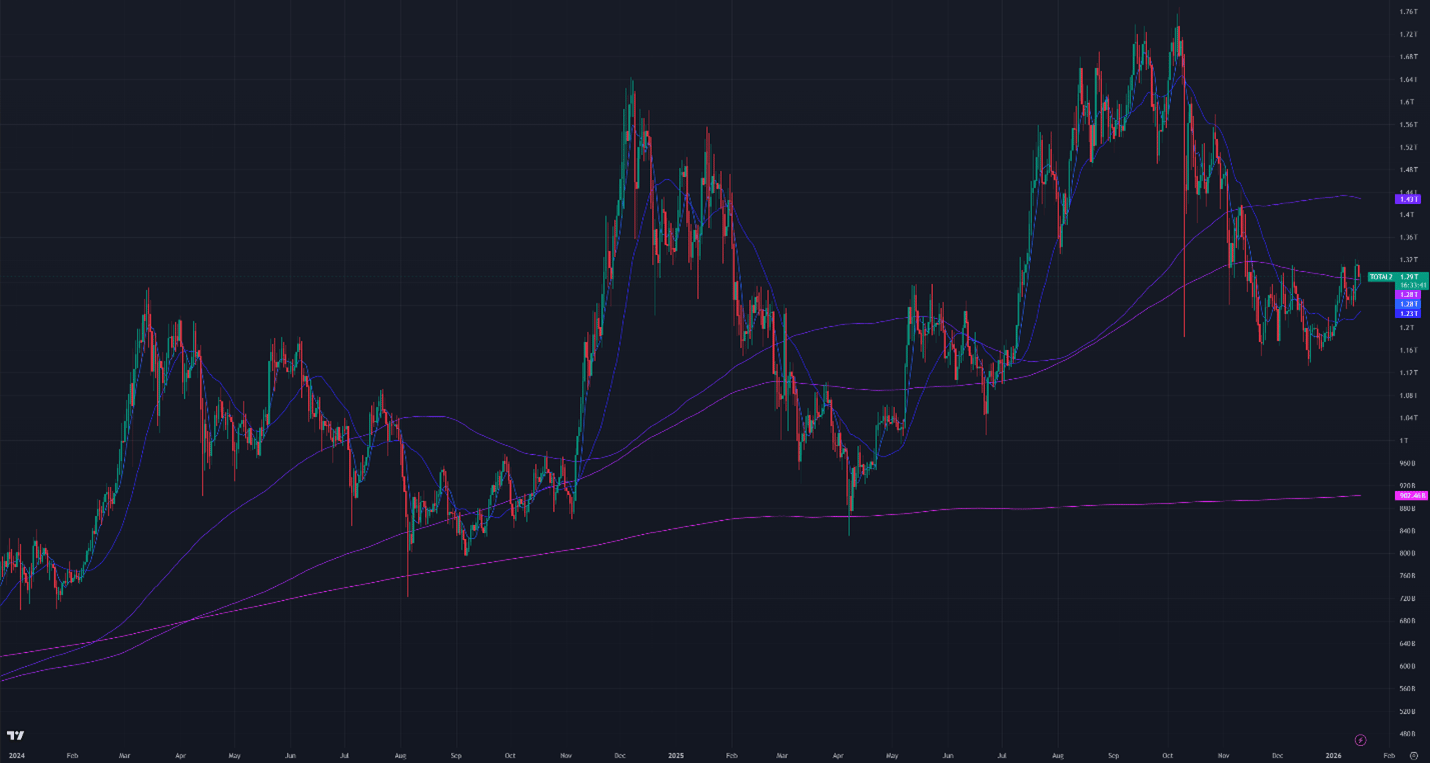

Aggregated altcoin market caps are down to $1.29T from $1.32T

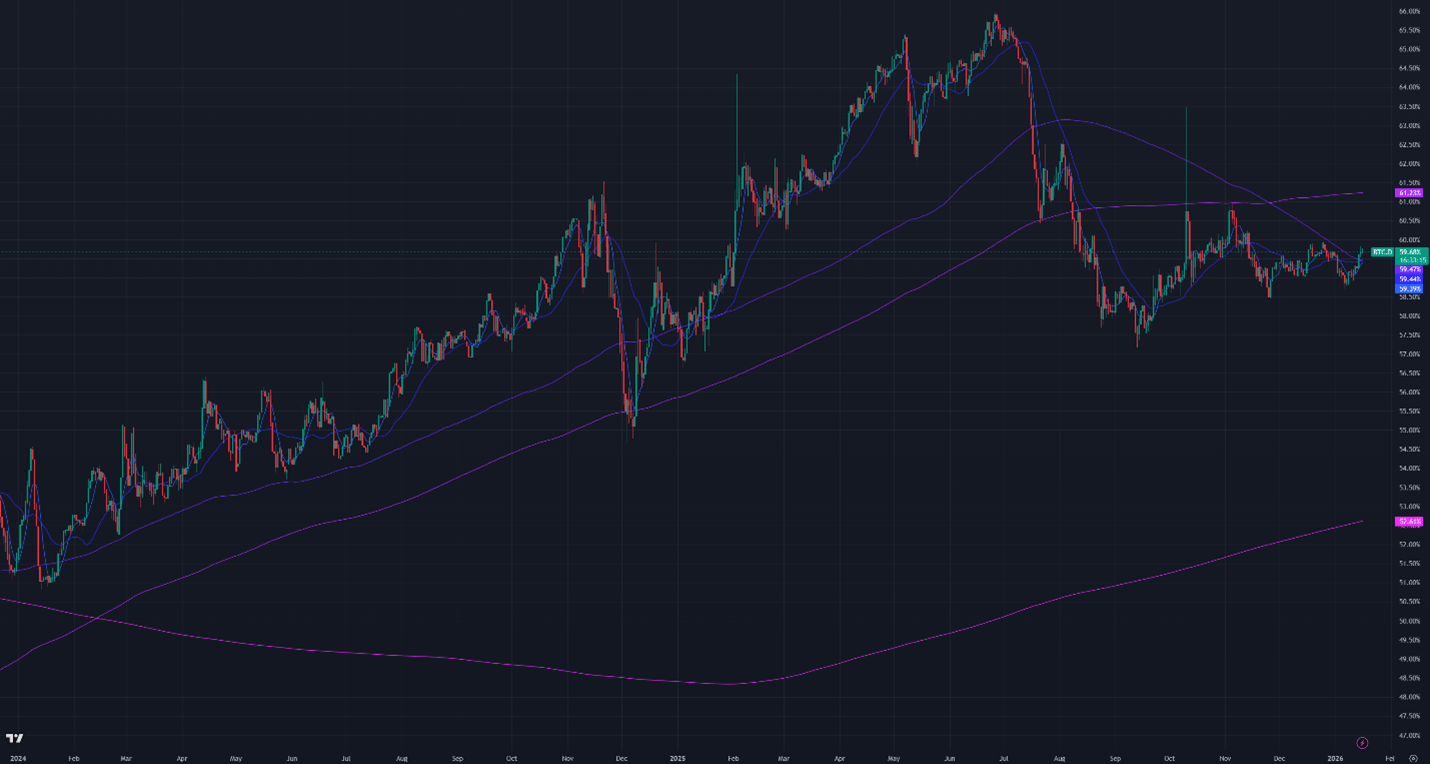

Bitcoin dominance rose 0.6% to 59.68%

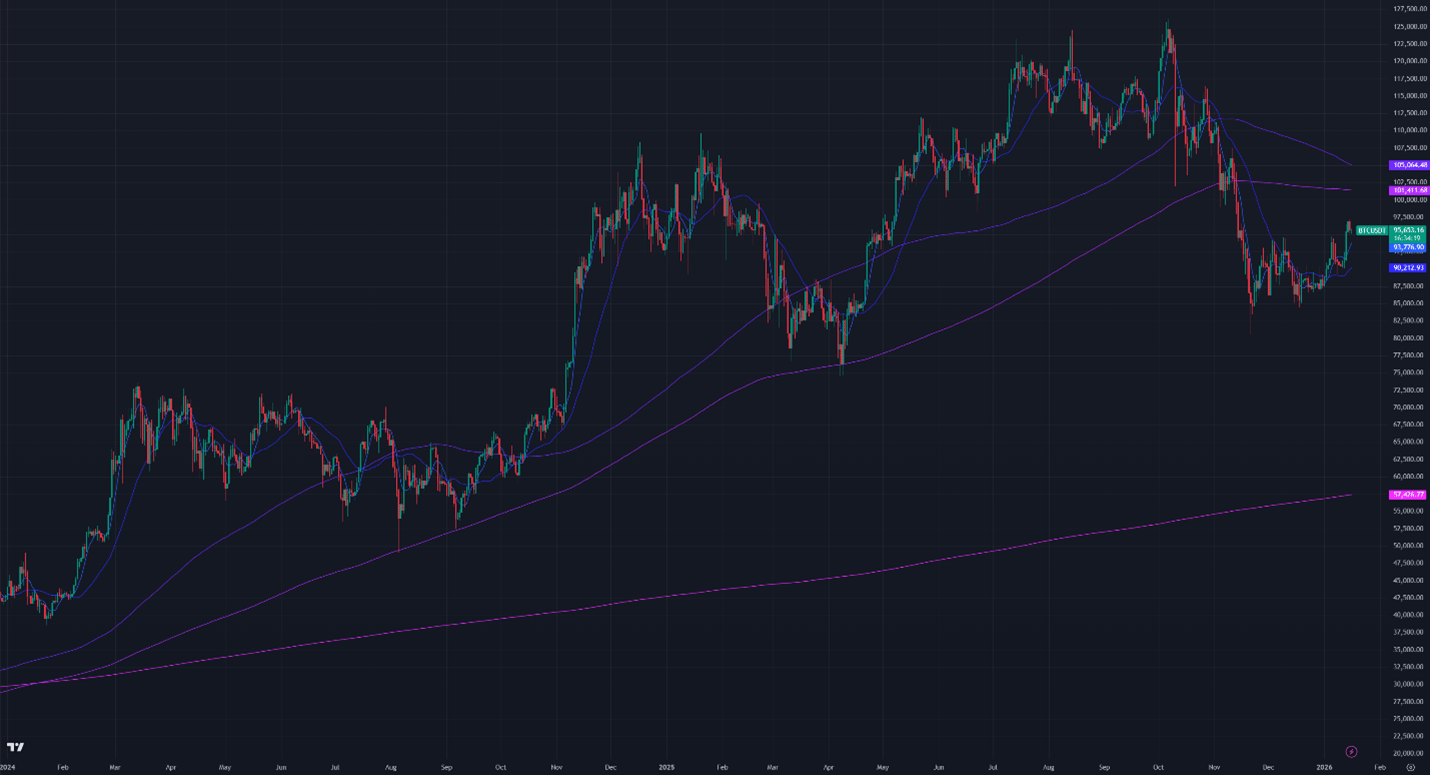

Figure 1: BTC Price, Daily Candles, & Moving Averages; 2 years; Source: Binance

Figure 2: Crypto Market Cap Excluding Bitcoin, Daily Candles, & Moving Averages; 2 years

Figure 3: Bitcoin Dominance, Daily Candles, & Moving Averages; 2 years

The moving averages (MA) in Figure 1 are:

Current Price: $95,700

7-Day MA: $93,800

30-Day MA: $90,200

180-Day MA: $105,100

360-Day MA: $101,400

200-Week MA: $57,400

Bitcoin is trading above both short-term moving averages, the 7-day and 30-day MAs, for the first time since early December. Price remains below the longer-term 180-day and 360-day MAs, leaving the intermediate-term downtrend unchanged. Support levels below the current price are $91,000, $86,000, $80,000, $76,000, and $57,500.

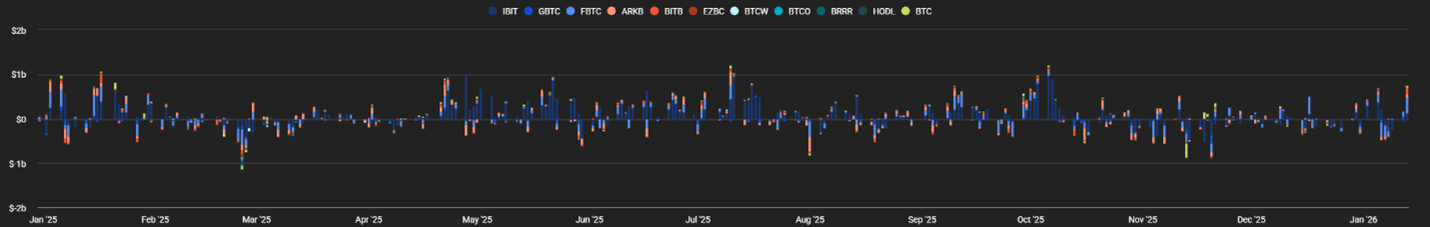

BTC ETF Flows

Net inflows totaled $1.56B this week, reversing the $1.1B in outflows recorded over three trading days earlier in January. Wednesday alone saw $840.6M in inflows, the largest single-day total of 2026 so far, offsetting the prior week’s outflows in one session.

BlackRock’s iShares Bitcoin Trust (IBIT) led flows with over $648M on Wednesday, setting a new daily record for the fund, while Fidelity’s FBTC added more than $125M. Cumulative net inflows across spot Bitcoin ETFs have now surpassed $58.1B since launch, with total ETF assets reaching $128B, or 6.56% of Bitcoin’s market cap.

Figure 4: Bitcoin ETF Flows, Daily Bars; Source: The Block

Volatility

Bitcoin’s implied volatility (DVOL) remains near two-year lows despite this week’s price action. DVOL stands at 40.14%, down from 41.75% last week. Volatility briefly dipped to 38% before returning to the low 40% range. Since the October sell-off, DVOL has remained range-bound between the low 40% and low 50% levels.

Implied volatility has been largely in a downtrend, driven by market-maker options hedging across Bitcoin-linked products such as ETFs, Bitcoin treasury companies, and miners, systematically compressing volatility and influencing price behavior around option expiration levels.

Figure 5: DVOL 2 Years; Bitcoin Index Price; Source: Deribit

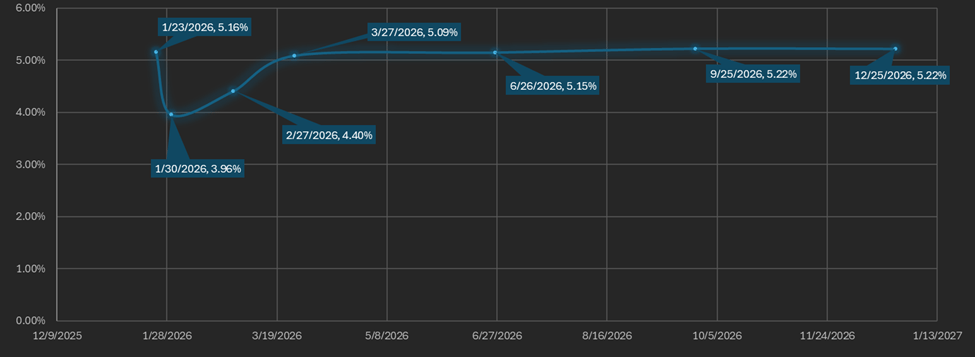

Basis Spread

The basis spread, or the price of the futures contract over its spot price, is positive across all maturities. The average (equal-weighted) basis spread fell from 5.31% APR to 4.89% APR week-over-week as front week futures premiums compressed.

The futures curve is in normal contango, with the front month (January 30) trading below both the back month and later maturities. The spread between the lowest and highest yielding contracts remained compressed at 1.27%.

Figure 6: Futures Curve; Maturity Date, APR %

Macro

On December 10, the Fed cut rates by 25 bps to 3.50%–3.75%, marking the third consecutive cut of 2025. Fed policy is now near neutral.

The December jobs report showed payroll growth of 50,000, while the unemployment rate edged down to 4.4%.

Geopolitical developments and heightened attention on Federal Reserve governance following reports of an investigation continue to add uncertainty to markets. Engagements involving Venezuela remain ongoing, with varying statements regarding the country’s oil sector contributing to volatility in energy markets.

Gold and silver extended their rally, with gold reaching $4,600 per ounce. Equity volatility increased modestly, with the VIX rising to 17% from recent lows below 15%, while remaining near its long-term average. The interest-rate-adjusted MOVE index remains at multi-year lows.

Sincerely,

The Hermetica Team