- Hermetica

- Posts

- Weekly Update - February 6, 2026

Weekly Update - February 6, 2026

Security First

IN THIS ISSUE

🛡️ Security First

🗞️ Fireblocks Integrates Stacks

💰 USDh Yield Recap

📈 Weekly Market Review

Jakob TL;DR

If you’ve followed Hermetica for any length of time, you’ve seen the pattern. Security comes first.

This week, we closed another milestone. Clarity Alliance completed its review of hBTC, and the full audit trail is public, from findings to remediation.

In parallel, Fireblocks is integrating Stacks, pushing BTCfi upstream into the custody stack used by over 2,400 enterprises. As that rail goes live, Fireblocks clients will be able to access BTCfi opportunities on Stacks, including institutional-grade BTC yield through hBTC.

Security First

hBTC has hit a new milestone: security audits are complete.

Clarity Alliance has published a security review of the hBTC protocol, closing out the latest audit cycle. The assessment covers the protocol’s smart contracts and interfaces with third-party partner protocols.

The audit trail anchors findings to specific commits, with remediation captured in the final code referenced by the report.

This is the second independent audit of the protocol. All audits are public and available in our documentation.

With the audit cycle complete, the protocol is cleared for production. The foundation is set.

Fireblocks Integrates Stacks

Institutional access to BTCfi just moved upstream.

Fireblocks is integrating Stacks, opening Bitcoin DeFi opportunities powered by Stacks to more than 2,400 enterprises.

Over 500M wallets trust Fireblocks, with more than $10T in digital asset transactions running through its rails. This integration brings BTCfi into the custody and operations layer institutions already use to move capital.

The result is distribution.

Institutional clients can access BTCfi opportunities on Stacks, including all Hermetica products. Fireblocks clients on the waitlist will access institutional-grade BTC yield through hBTC as the integration goes live.

USDh Yield Recap

USDh pulled 3% APY this week.

Dip? Sorry, didn’t see it from up here. 😌

Market Review

Bitcoin reached a low near $59,000, down more than 30% over five trading days in its sharpest selloff since the FTX collapse. More than $5B in leveraged positions were liquidated during the week, including $2B on Thursday alone.

Spot selling was concentrated in Binance markets and initially absorbed by demand from retail and DATs like Strategy (MSTR), but as macro liquidity tightened in recent weeks, selling pressure outweighed demand. CryptoQuant reports that 44% of Bitcoin supply is now held at a loss, a level historically associated with early bear market phases. The average cost basis for U.S. spot Bitcoin ETF holders is around $90,200, implying the ETF investor base is down roughly 30%.

The S&P 500 fell by 1.23% to 6,738, while the NASDAQ dropped 1.59% to 22,541, marking a third straight session of losses.

Data Summary:

DVOL: 72% (spiked to 90% intraweek)

Equal-weighted futures basis spread: fell to 1.73%

Futures curve remains in steep contango in the back months, even as the front month slipped below spot amid liquidation pressure

Perp funding rates turned negative midweek as longs were liquidated and remain so

Aggregated altcoin market caps are down to $0.91T from $1.18T last week

Bitcoin dominance rose to 58.71% from 58.09%

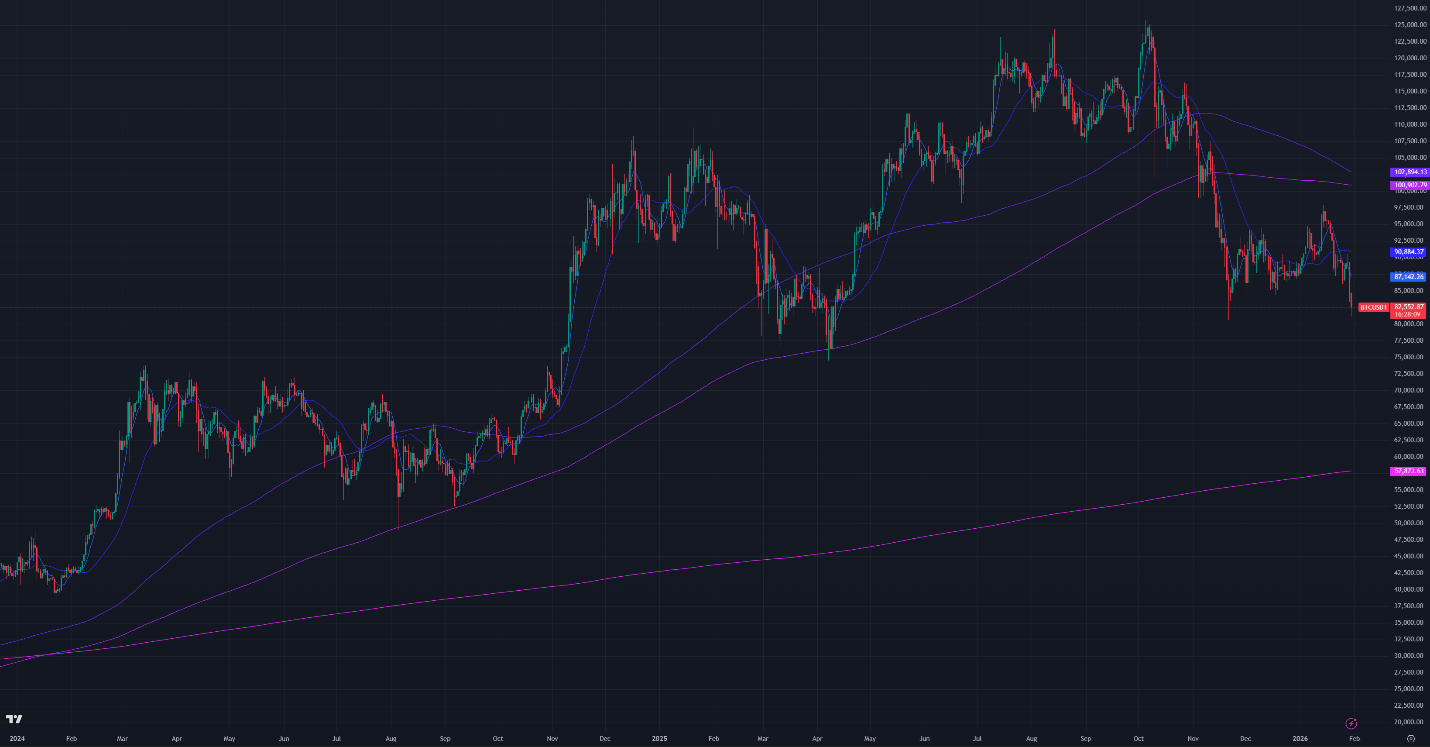

Figure 1: BTC Price, Daily Candles, & Moving Averages; 2 years; Source: Binance

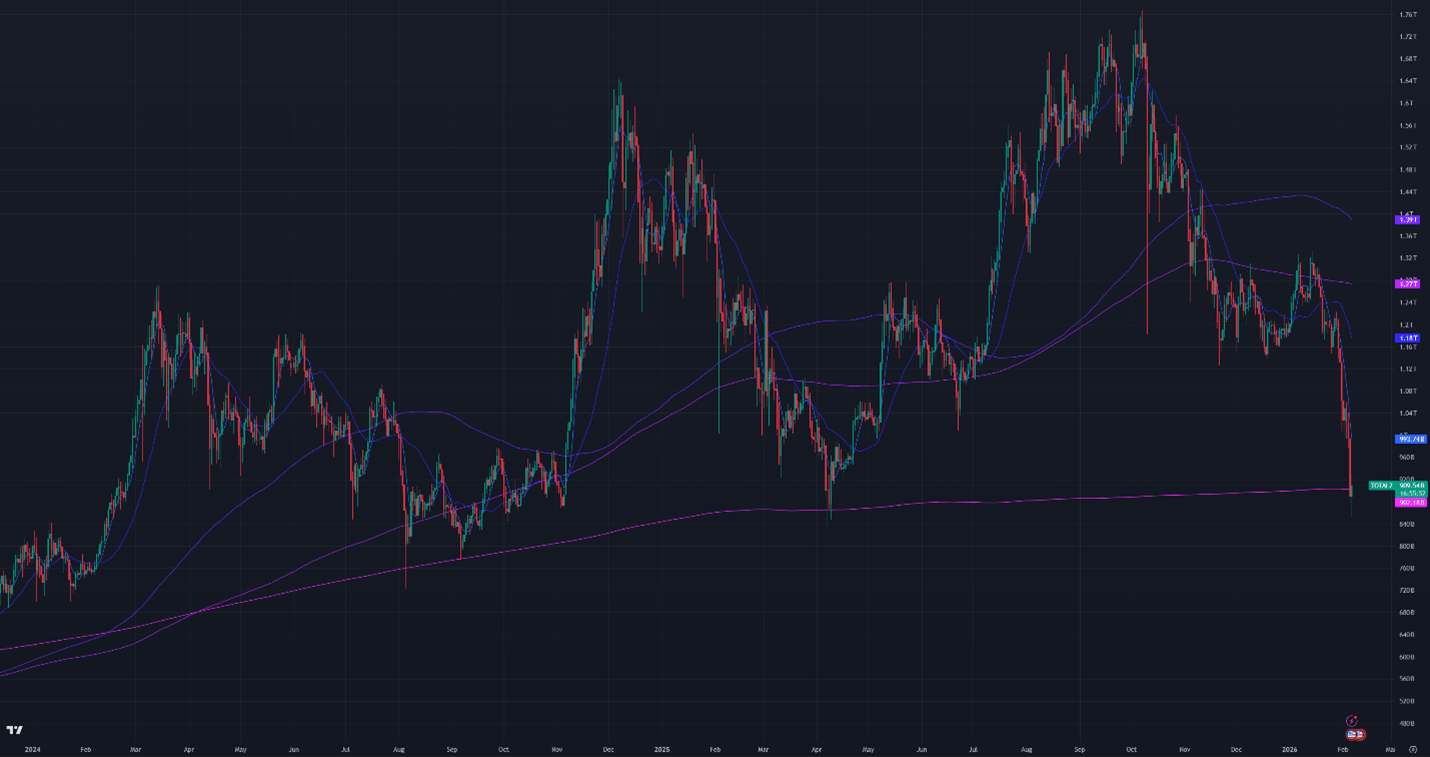

Figure 2: Crypto Market Cap Excluding Bitcoin, Daily Candles, & Moving Averages; 2 years

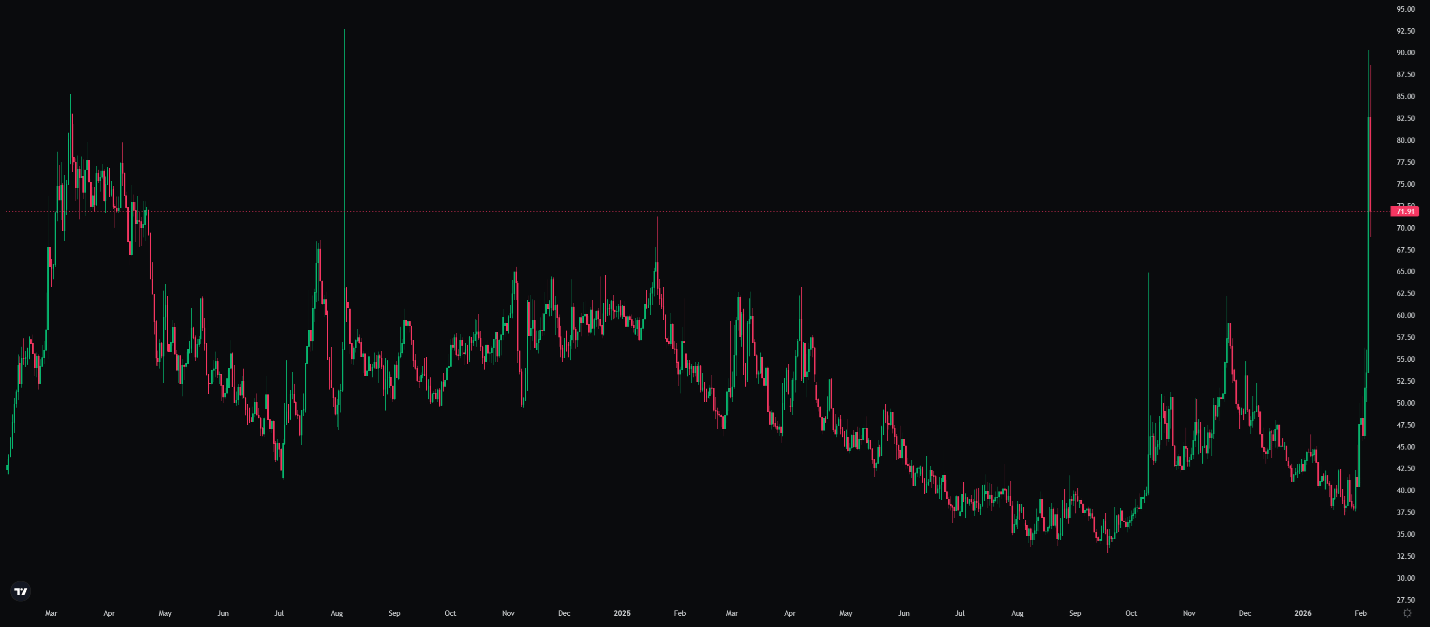

Figure 3: Bitcoin Dominance, Daily Candles, & Moving Averages; 2 years

The moving averages (MA) in Figure 1 are:

Current Price: $69,000

7-Day MA: $73,000

30-Day MA: $86,600

180-Day MA: $101,200

360-Day MA: $100,500

200-Week MA: $58,000

Bitcoin is trading below all major moving averages for the first time since the 2022 bear market lows. Price moved below the 7-day, 30-day, 180-day, and 360-day MAs in rapid succession this week. The 200-week MA near $58,000 remains a key long-term reference level and has historically aligned with cycle lows.

Support levels are now at $60,000, $58,000, $52,000, and $48,000. Resistance levels are $70,000, $76,000, $80,000, and $86,000.

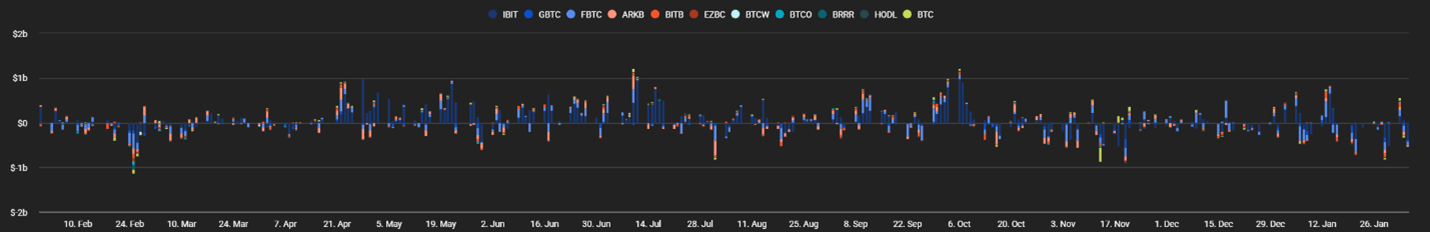

BTC ETF Flows

Net outflows were approximately $1.2B. ETF flows have been negative except for $561M of inflows on Monday. BlackRock’s IBIT, a relative bright spot in prior weeks, saw $528M of withdrawals in a single day. Cumulative net inflows have fallen to about $55B from a mid-January peak of $57.8B. Total ETF assets under management have declined to roughly $97B from a $168B peak, a $71B drop since October. From November 2025 through early February 2026, the spot Bitcoin ETF complex has shed roughly $6.2B in net capital, the longest sustained outflow streak since launch.

Figure 4: Bitcoin ETF Flows, Daily Bars; Source: The Block

Volatility

Bitcoin’s implied volatility (DVOL) rose this week as liquidations drove prices lower. DVOL rose from 37% to a peak of 90%, the largest weekly move since early 2023 and the highest level since November 2022. DVOL has since cooled to about 72%, breaking the 40%–50% range that had held since the October 2025 crash.

The DVOL downtrend in place since late 2023 has broken. Implied volatility was at two-year lows in September 2025, moved into the 40s during the October–November declines, and reached levels not seen since the FTX collapse during this week’s price action. Volatility-suppressing forces such as TradFi call selling, market maker hedging, and options pinning at expiration gave way to liquidations and reduced market maker liquidity.

Figure 5: DVOL 2 Years; Bitcoin Index Price; Source: Deribit

Basis Spread

The basis spread, or futures pricing over spot, fell this week as liquidations pushed market makers to hedge with long-term futures. Front-month futures traded in backwardation at times on peak selling days, a rare occurrence that signals extreme stress. The average equal-weighted basis spread fell to 1.73%, driven primarily by negative front-week and front-month futures.

The futures curve shifted from last week’s inverted contango to intermittent backwardation. Perpetual open interest declined as more than $5B in positions were liquidated over the week. Perp funding rates turned negative during the most intense selling, indicating capitulation.

Figure 6: Futures Curve; Maturity Date, APR %

Macro

The Federal Reserve held its first 2026 FOMC meeting on January 28, voting 10–2 to keep the federal funds rate at 3.50%–3.75%.

Meanwhile, Earnings season pressured AI-linked equities as investors focused on the scale of hyperscaler spending versus near-term returns. Alphabet guided 2026 capex at $175–$185 billion and Amazon guided about $200 billion for AI infrastructure. Alphabet, Amazon, Microsoft, and Meta have committed about $660 billion of 2026 AI capex versus roughly $400 billion in annual net profits, weighing on the neocloud segment of independent AI datacenter companies.

Precious metals experienced historic volatility this week. Gold fell 21% from near $5,600 to $4,404 on Monday, then recovered to ~$4,850 by Thursday. Silver dropped 41% from above $121 to $72, its largest percentage decline since March 1980.

The VIX approached 20% during the week’s heaviest equity selling before easing, while the Dollar Index (DXY) rebounded from recent four-year lows. Cross-asset correlations rose as Bitcoin, gold, silver, tech, and software sold off together, consistent with forced deleveraging rather than fundamental repricing. Treasuries, European equities, and select cyclical sectors held up as the rotation from tech and risk assets into “old economy” names accelerated.

Sincerely,

The Hermetica Team