- Hermetica

- Posts

- Hermetica: What is in the Name?

Hermetica: What is in the Name?

Names are not arbitrary. They reveal how a thing wishes to be understood

For Hermetica, the name is not branding. It is orientation.

Hermetica was not named for effect or symbolism. It communicates a specific approach to system design, one grounded in structure and respect for first principles. The name reflects how the platform is built and how risk is understood, expressed, and managed.

Hermetica takes its name from Hermes Trismegistus, a figure historically associated with communication, exchange, accounting, and mathematics. Hermes was the Divine Messenger. His role was mediation; he transmitted, translated, and preserved meaning as it moved between domains governed by different rules.

The writings attributed to Hermes Trismegistus, later compiled as the Corpus Hermeticum, focused on how complex systems remain coherent as they scale. They emphasized translation without distortion and limits before expansion. The underlying idea was simple. If the foundation is strong and adheres to first principles, everything built on top will hold.

That perspective informs Hermetica’s approach.

The legendary Hellenistic figure Hermes Trismegistus

As Above, So Below

One of the most enduring Hermetic ideas is the principle of correspondence, expressed by the phrase “as above, so below.”

In practical terms, it means that structure must remain consistent across layers of a system. If something is opaque at the top, it will be opaque underneath. If risk is hidden at the base, it will surface elsewhere.

Bitcoin exemplifies this principle in practice. Its design is fundamentally sound across all domains – security is based on energy, truth is based on math, and transparency is structural, not discretionary. Supply is fixed and transactions are publicly verifiable. The system behaves as designed at all times, not because of intervention, but because of how it is constructed.

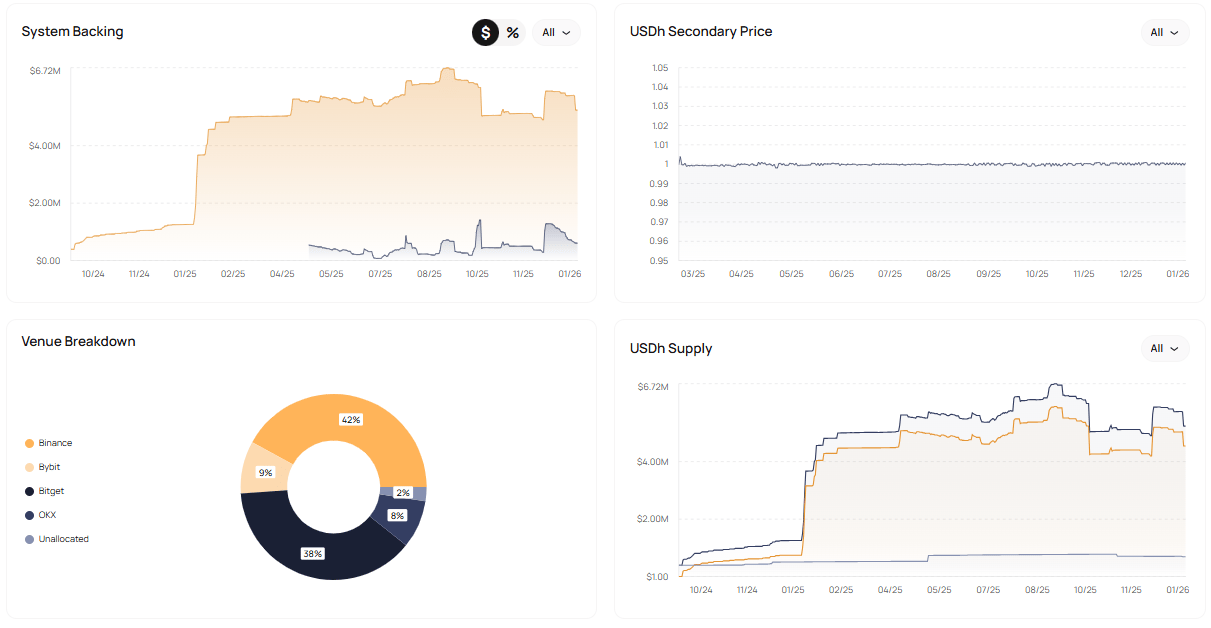

Hermetica follows the same principle: transparency and risk control are embedded directly into its architecture. Security comes first, risk is explicit, and system behavior is observable and verifiable across all conditions.

Example: USDh Transparency Dashboard

Rhythm and Structural Resilience

Many principles associated with Hermetic thought translate directly into Hermetica’s structure.

The principle of vibration and rhythm reflects the reality that the system Hermetica operates within is always in motion. Markets do not settle. Prices move continuously. Any structure that assumes a stable backdrop introduces risk by default.

Hermetica doesn’t position around a single market view; our yield products remain functional even as market conditions change. Stability is not maintained through discretionary intervention or algorithmic pegs, but through neutrality to price movement.

This structure has been tested in practice. Our products have operated over multiple cycles and market regimes without incident, including through periods of sudden drawdowns and exchange failure.

Outcomes followed from structure.

A Name, A Commitment

In finance, hermetic systems are those built with explicit assumptions, controlled risk boundaries, and minimal reliance on discretion. They expose what must be visible and limit channels through which unpriced risk can propagate.

Hermetica aligns with that discipline. The name places the platform within a lineage that values disciplined design, clear boundaries, and fidelity to first principles.

That is what is in the name.